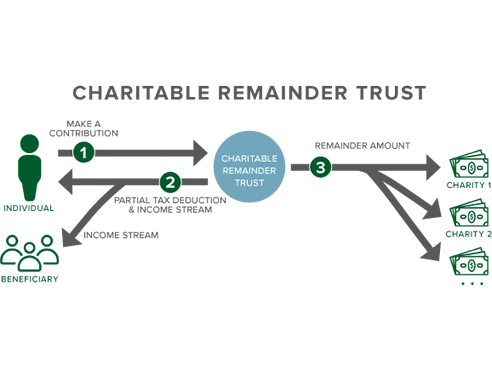

Charitable Remainder Trust

Alleviate capital gains taxes and donate to a good cause

Caption not specified

Charitable remainder trusts (CRTs) are gifts of either cash or appreciated assets (such as investment property that has been held for many years) to irrevocable trusts, which are established for the benefit of some charitable organization eventually, while serving to create a more passive trusted continuing source of income for life of typically one or more persons, and deferring any significant capital gains tax event, which would otherwise be necessary to incur in an outright sale during one’s lifetime.

There are strict rules on how CRTs are to be established and maintained, which is why a specialized accountant/financial advisor who can act as trustee, is most efficient and effective to have. Also, it is important to have an attorney with familiarity setting these up, in order to ensure that the CRT is established correctly. In the right circumstances, these are very effective vehicles for getting out of day to day investment property operations, while allowing for a comfortable retirement by maintaining the income stream from all of the appreciated equity, without having to manage the asset(s) anymore, and deferring any capital gains taxes during one’s lifetime. This exit strategy is typically more common among investors without children, and/or with big philanthropic goals, along with an interest in avoiding huge capital gains tax consequences.

Charitable Remainder Trust

More Case Studies

1031 Exchange

Local Multifamily into Local Multifamily

1031 Exchange

Local Multifamily into Out of State Multifamily

1031 Exchange

Multifamily into Triple Net Leased (“NNN”) Investment(s)